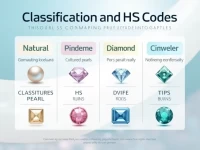

HS Codes Key to Exporting Pearls and Gemstones Successfully

This article provides a detailed overview of the HS codes related to the export of pearls and gemstones, covering the classification and tax rebate rates for natural pearls, cultured pearls, diamonds, and other gemstones. It offers important guidance for trade practitioners, facilitating smooth export processes.